| ¨ | Fee paid previously with preliminary materials. | |||

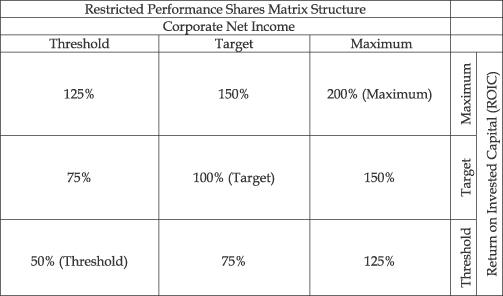

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: | |||

STEPAN COMPANY

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on May 3, 2011April 30, 2013

at 9:00 a.m. (CDT)

To the Stockholders:

Notice is hereby given that the Annual Meeting of Stockholders of STEPAN COMPANY (the “Company”) will be held at the Company’s Administrative and Research Center at Edens Expressway and Winnetka Road, Northfield, Illinois, on Tuesday, May 3, 2011,April 30, 2013, at 9:00 a.m. (CDT), for the following purposes:

| 1. | To elect |

| 2. | To approve an amendment to the |

| 3. | To approve |

| To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for |

| To transact such other business as may properly come before the meeting. |

The Board of Directors has designated the close of business on March 4, 2011,1, 2013, as the record date for determining holders of the Company’s 5 1/2% Convertible Preferred Stock and the Company’s Common Stock entitled to notice of and to vote at the meeting.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on May 3, 2011.April 30, 2013.

The Proxy Statement and Annual Report to Stockholders, including Form 10-K for fiscal year 2012, are available at http://www.edocumentview.com/SCL.

The proxy materials available at http://www.edocumentview.com/SCL include the Notice of Annual Meeting of Stockholders, Proxy Statement, Form of Proxy, Annual Report to Stockholders, and Form 10-K for the year 2010.

Directions to the Annual Meeting of Stockholders are available at http://www.stepan.com, under “Investors—“Investor Relations—Annual Meeting” for those stockholders who plan to attend the meeting.Annual Meeting.

By order of the Board of Directors,

KATHLEEN O. SHERLOCKH. EDWARD WYNN

Assistant Secretary

Northfield, Illinois

March 31, 201127, 2013

The Board of Directors extends a cordial invitation to all stockholders to attend the meeting.Annual Meeting. Whether or not you plan to attend the meeting, please mark, sign and mail the enclosed proxy card in the return envelope provided as promptly as possible.

As a reminder, brokers may not vote your shares for non-routine matters such as the election of directors, the approval to increase the number of an equity compensation plan,authorized shares of the Company’s Common Stock, or the advisory vote on the compensation paid toof the Company’s named executive officers (“Say-on-Pay” vote), or the advisory vote on the frequency of voting on future Say-on-Pay votes in the absence of your specific instructions as to how to vote. Therefore, we urge you to provide your broker with voting instructions by returning your proxy card so your vote for all proposals can be counted.

March 31, 201127, 2013

PROXY STATEMENT

For the Annual Meeting of Stockholders of

STEPAN COMPANY

Edens Expressway and Winnetka Road

Northfield, Illinois 60093

To be held at 9:00 a.m. (CST)(CDT) on May 3, 2011April 30, 2013

INFORMATION CONCERNING SOLICITATION AND VOTING

The enclosed proxy is solicited by the Board of Directors and the Company will bear the entire expense of solicitation. Such solicitation is being made by mail, and the Company’s officers and employees may solicit proxies from stockholders personally or by telephone, mail or other means. The Company will make arrangements with the brokers, custodians, nominees and other fiduciaries who request the forwarding of solicitation material to the beneficial owners of shares of the Company’s stock held of record by such brokers, custodians, nominees and other fiduciaries, and the Company will reimburse them for their reasonable out-of-pocket expenses.

At the close of business on March 4, 2011,1, 2013, the record date for the meeting, there were 520,08961,935 shares of the Company’s 5 1/2% Convertible Preferred Stock (“Preferred Stock”) outstanding, each share of which is convertible into 1.141752.2835 shares of the Company’s Common Stock (“Common Stock”) and is entitled to 1.141752.2835 votes on each matter to be voted on at the meeting, and, assuming all outstanding shares of Preferred Stock were converted, there would have been 10,752,94822,183,547 shares of Common Stock outstanding, each share of which is entitled to one vote on each matter to be voted on at the meeting. The beneficial ownership, executive compensation and director compensation information presented in this proxy statement reflect the effects, where applicable, of the two-for-one (2-for-1) stock split of the Common Stock that was paid on December 14, 2012.

This proxy statement and proxy are first being sent or givendistributed to stockholders commencing on or about March 31, 2011.27, 2013.

You may either vote “FOR” or “WITHHOLD” authority to vote for each of the nominees for the Board of Directors. You may vote in favor of holding the advisory vote on named executive officer compensation “EVERY ONE YEAR,” “EVERY TWO YEARS” OR “EVERY THREE YEARS,” or you may choose to “ABSTAIN” from voting on this proposal. You may vote “FOR,” “AGAINST” or “ABSTAIN” on the other proposals.

In connection with any other business that may properly come before the meeting, of which the Board of Directors is not currently aware, votes will be cast pursuant to the authority granted by the enclosed proxy in accordance with the best judgment of a majority of the persons present andindividuals acting under the proxy.

If you submit your proxy but abstain from voting or withhold authority to vote on one or more matters, your shares will be counted as present at the meeting for the purposes of determining a quorum. Your shares also will be counted as present at the meeting for the purpose of calculating the vote on the particular matter with respect to which you abstained from voting or withheld authority to vote. Any proxy given pursuant to this solicitation may be revoked by the stockholder at any time prior to the voting of the proxy.

1

If you abstain from voting on a proposal, your abstention has the same effect as a vote against that proposal. If you withhold your authority to vote for any director nominee, your withholding has the same effect as a vote against that director.

If you hold your shares in street name and do not provide voting instructions to your broker, custodian, nominee or other fiduciary, your shares will be considered “broker non-votes” and will not be voted on any non-routine matters, which include the election of directors, the approval to increase the number of authorized shares of the equity compensation plan, the advisory vote on executive compensation,Company’s Common Stock, and the advisory vote on the frequency of future stockholder advisory votes onapproving named executive officer compensation. Shares that constitute broker non-votes may be voted on the ratification of auditors and will be counted as present at the meeting for the purpose of determining a quorum, but will not be entitled to vote on non-routine proposals. Please instruct your broker or bank so your vote can be counted on all proposals.

The required quorum at the Annual Meeting of Stockholders is a majority of the outstanding shares of the Company’s voting stock as of the record date. In order to ensure the presence of holders of shares representing the necessary quorum at the Annual Meeting, of Stockholders, please mark, sign and return the enclosed proxy promptly in the envelope provided. No postage is required if mailed in the United States. Even if you sign and return your proxy, you are invited to attend the meeting.

The Company has adopted a procedure called “householding,” which the Securities and Exchange Commission (“SEC”) has approved. Under this procedure, the Company expects to deliver a single copy of the proxy materials to multiple stockholders who share the same address unless the Company has received contrary instructions from one or more of the stockholders. This procedure reduces the Company’s printing and mailing costs, and the environmental impact of the Company’s annual meetings. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or verbal request, the Company will deliver promptly a separate copy of the proxy materials to any stockholder at a shared address to which the Company delivered a single copy of these documents. To receive a separate copy of the proxy materials, stockholders may write or call the Company at the following contact: Stepan Company, Secretary’s Office, Edens Expressway and Winnetka Road, Northfield, Illinois 60093; Telephone: (847) 446-7500.

ELECTION OF DIRECTORS

Stockholders and the persons named in the enclosed proxy will vote, pursuant to the authority granted by the stockholder in the enclosed proxy, on the election of Messrs. Joaquin Delgado andMichael R. Boyce, F. Quinn Stepan Jr.and Edward J. Wehmer as Directors of the Company to hold office until the Annual Meeting of Stockholders to be held in the year 2014.2016.

In the event any one or more of such nominees is unable to serve as Director, votes will be cast, pursuant to the authority granted in the enclosed proxy, for such person or persons as may be designated by the Board of Directors. The Board of Directors at this time is not aware of any nominee who is or will be unable to serve as Director, if elected.

Under the Company’s Restated Certificate of Incorporation and By-laws, Directors are elected by a plurality of the voting power of the shares of Preferred Stock and Common Stock present in person or represented by proxy at the meeting and entitled to vote, voting together as a single class. The outcome of the election will not be affected by holders of shares of Preferred Stock or Common Stock that withhold authority to vote in the election of Directors.

The Board of Directors is divided into three classes serving staggered three-year terms. Directors for each class are elected at the Annual Meeting of Stockholders in the year in which the term for their class expires.

2

Nominees Forfor Director

The following table sets forth certain information about the nominees for Director:

Name of Nominee | Principal Occupation, Business Experience and Other Directorships | Year of First Election as Director | Number and Percent of Shares of Common Stock Beneficially Owned(1) | |||||||||||

Joaquin Delgado | Executive Vice President, Electro and Communications Business of 3M Company, a global diversified technology company, since 2009. Vice President and General Manager, Electronic Markets Materials Division of 3M Company, from 2007 to 2009. Vice President, Research and Development and New Business Ventures, Consumer and Office Business of 3M Company, from 2005 to 2007. President of 3M Korea Ltd. from 2003 to 2005. Age—51 | N/A | 0 | * | ||||||||||

F. Quinn Stepan, Jr. | President and Chief Executive Officer of the Company since January 2006. President and Chief Operating Officer of the Company from February 1999 to December 2005. Director of Follett Corporation. Age—50 | 1999 |

| 791,837

| (2) (3) | 7.3 | % | |||||||

Name of Nominee | Principal Occupation, Business Experience and Other Directorships During the Past Five Years, and Age | Year of First Selection as Director | Number and Percent of Shares of Common Stock Beneficially Owned(1) | |||||||||||

Michael R. Boyce | Chairman and Chief Executive Officer of PQ Corporation, a global specialty chemical and catalyst company, since 2005. Chairman and Chief Executive Officer of Peak Investments, an operating and acquisition company, since 1998. From 1990 to 1998, President and Chief Operating Officer of Harris Chemical Group, Inc. Director of PQ Corporation and AAR Corp. Age—65 | 2010 | 3,669 | (2) | * | |||||||||

F. Quinn Stepan | Chairman of the Company since November 1984. Chief Executive Officer of the Company from November 1984 to December 2005. Age—75 | 1967 | 1,771,429 | (3) | 8.0 | % | ||||||||

Edward J. Wehmer | President, Chief Executive Officer and founder of Wintrust Financial Corporation, a financial services company, since May 1998. Prior to May 1998, President and Chief Operating Officer of Wintrust Financial Corporation since its formation in 1996. Director of Wintrust Financial Corporation. Involved in several charitable and professional organizations. Age—58 | 2003 | 28,216 | (4) | * | |||||||||

* Less than one percent of outstanding shares of Common Stock.

| (1) | Represents number of Common Stock shares beneficially owned as of March |

| (2) | Includes |

| (3) | See Notes (5) and (6) to table under Security Ownership—Security Ownership of Certain Beneficial Owners. |

| (4) | Includes (a) 11,190 shares that the Director has the right to acquire within 60 days through the exercise of stock |

3

PROPOSAL: The Board of Directors recommends that the stockholders vote FOR the election of Messrs. Joaquin Delgado andMichael R. Boyce, F. Quinn Stepan Jr.and Edward J. Wehmer to the Board of Directors each for a three-year term.

3

Directors Whose Terms Continue

The following table sets forth certain information about those Directors who are not up for re-electionelection as their respective term of office does not expire this year:

Name of Director | Principal Occupation, Business Experience and Other Directorships During the Past Five Years, and Age | Year of First Election as Director | Term Expires | Number and Percent of Shares of Common Stock Beneficially Owned(1) | ||||||||||||||

Michael R. Boyce | Chairman and Chief Executive Officer of PQ Corporation, an industrial chemicals company, since 2005. Chairman and Chief Executive Officer of Peak Investments, an operating and acquisition company, since 1998. From 1990 to 1998, President and Chief Operating Officer of Harris Chemical Group, Inc. Director of PQ Corporation and AAR Corp. Age—63 | 2010 | 2013 | 333 | (2) | * | ||||||||||||

Gary E. Hendrickson | President and Chief Operating Officer of The Valspar Corporation, a global paints and coatings manufacturer, since February 2008. Senior Vice President, Wood Coatings, Architectural, and Federal Business Units; and President, Asia Pacific of The Valspar Corporation, from 2005 to February 2008. Group Vice President, Global Wood Coatings; and President, Asia Pacific of The Valspar Corporation from 2004 to 2005. Director of The Valspar Corporation. Age—54 | 2009 | 2012 | 3,458 | (3) | * | ||||||||||||

Gregory E. Lawton | Consultant. President and Chief Executive Officer of JohnsonDiversey, Inc., a manufacturer of cleaning products, from October 2000 to February 2006. From January 1999 to September 2000, President and Chief Operating Officer of Johnson Wax Professional. President of NuTone, Inc., a subsidiary of Williams plc based in Cincinnati, Ohio from 1994 to 1998. From 1989 to 1994, served with Procter & Gamble as Vice President and General Manager of several consumer product groups. Director of General Cable and American Trim. Age—60 | 2006 | 2012 | 7,465 | (4) | * | ||||||||||||

Name of Director | Principal Occupation, Business Experience and Other Directorships During the Past Five Years, and Age | Year of First Selection as Director | Term | Number and Percent of Shares of Common Stock Beneficially Owned(1) | ||||||||||||||

Randall S. Dearth | President and Chief Executive Officer of Calgon Carbon Corporation, a global manufacturer of activated carbon and innovative treatment systems, since 2012. President and Chief Executive Officer of LANXESS Corporation, a global chemicals manufacturer, from 2004 to 2012. Director of Calgon Carbon Corporation. Age—49 | 2012 | 2015 | 1,270 | * | |||||||||||||

Joaquin Delgado | Executive Vice President, Health Care Business Group of 3M Company, a global diversified technology company, since 2012. Executive Vice President, Electro and Communications Business of 3M Company, from 2009 to 2012. Vice President and General Manager, Electronic Markets Materials Division of 3M Company, from 2007 to 2009. Vice President, Research and Development and New Business Ventures, Consumer and Office Business of 3M Company, from 2005 to 2007. President of 3M Korea Ltd. from 2003 to 2005. Age—53 | 2011 | 2014 | 2,114 | * | |||||||||||||

4

Name of Director | Principal Occupation, Business Experience and Other Directorships During the Past Five Years, and Age | Year of First Election as Director | Term Expires | Number and Percent of Shares of Common Stock Beneficially Owned(1) | ||||||||||||||

F. Quinn Stepan | Chairman of the Company since November 1984. Chief Executive Officer of the Company from November 1984 to December 2005. Age—73 | 1967 | 2013 | 1,609,458 | (5) | 14.9 | % | |||||||||||

Edward J. Wehmer | President, Chief Executive Officer and founder of Wintrust Financial Corporation, a financial services company, since May 1998. Prior to May 1998, President and Chief Operating Officer of Wintrust Financial Corporation since its formation in 1996. Director of Wintrust Financial Corporation. Involved in several charitable and professional organizations. Age—56 | 2003 | 2013 | 12,530 | (6) | * | ||||||||||||

Name of Director | Principal Occupation, Business Experience and Other Directorships During the Past Five Years, and Age | Year of First Selection as Director | Term | Number and Percent of Shares of Common Stock Beneficially Owned(1) | ||||||||||||||

Gregory E. Lawton | Consultant. President and Chief Executive Officer of JohnsonDiversey, Inc., a manufacturer of cleaning products, from October 2000 to February 2006. From January 1999 to September 2000, President and Chief Operating Officer of Johnson Wax Professional. President of NuTone, Inc., a subsidiary of Williams plc based in Cincinnati, Ohio from 1994 to 1998. From 1989 to 1994, served with Procter & Gamble as Vice President and General Manager of several consumer product groups. Director of General Cable and American Trim. Age—62 | 2006 | 2015 | 18,052 | (2) | * | ||||||||||||

F. Quinn Stepan, Jr. | President and Chief Executive Officer of the Company since January 2006. President and Chief Operating Officer of the Company from February 1999 to December 2005. Director of Follett Corporation from February 2005 to July 2011. Age—52 | 1999 | 2014 |

| 1,353,966

| (3) (4) | 6.1 | % | ||||||||||

*Less than one percent of outstanding shares of Common Stock.

| (1) | See Note (1) to table under Nominees for Director. |

| (2) | Includes |

| (3) | Includes 576,300 shares held by the Company’s qualified plans and deemed beneficially owned by the Plan Committee, of which James E. Hurlbutt, Gregory Servatius and F. Quinn Stepan, Jr. are members and employees of the Company. The Plan Committee selects the investment manager of the Stepan Company Trust for Qualified Plans under the terms of a Trust Agreement effective December 1, 2011, with Bank of America, N.A. (“Bank of America”). Bank of America expressly disclaims any beneficial ownership in the securities of this plan. |

| (4) | Includes (a) |

Family Relationships

F. Quinn Stepan, Jr. is the son of F. Quinn Stepan.

5

SECURITY OWNERSHIP

Security Ownership of Certain Beneficial Owners

As of March 4, 2011,1, 2013, the following persons were the only persons known to the Company to beneficially own more than five percent of the Company’s Common Stock:

| Number of Shares of Common Stock Beneficially Owned(2)(6) | Total Shares | Percentage of Outstanding Shares of Common Stock | Number of Shares of Common Stock Beneficially Owned(1)(2) | Percentage of Outstanding Shares of Common Stock | ||||||||||||||||||||||||||||

| Voting and/or Investment Power | Voting and/or Investment Power | Total Shares | ||||||||||||||||||||||||||||||

Name and Address(1) | Sole | Shared | ||||||||||||||||||||||||||||||

Name and Address | Sole | Shared | Total Shares | Percentage of Outstanding Shares of Common Stock | ||||||||||||||||||||||||||||

Royce & Associates, LLC(3) | 1,840,542 | |||||||||||||||||||||||||||||||

F. Quinn Stepan(4) | 1,304,689 | (5) | 304,769 | (3) | 1,609,458 | 14.9 | % | 1,240,887(5) | 530,542(6) | 1,771,429 | ||||||||||||||||||||||

Royce & Associates, LLC(7) | 672,479 | 672,479 | 6.2 | % | ||||||||||||||||||||||||||||

BlackRock, Inc. | 614,195 | 614,195 | 5.7 | % | 1,259,398 | 1,259,398 | 5.7 | % | ||||||||||||||||||||||||

The Vanguard Group, Inc.(8) | 22,210 | 1,142,382 | 1,164,592 | 5.2 | % | |||||||||||||||||||||||||||

As of March 4, 2011, the following persons1, 2013, there were the onlyno persons known to the Company to beneficially own more than five percent of the Company’s Preferred Stock:Stock.

| Number of Shares of Preferred Stock Beneficially Owned(2) | Percentage of Outstanding Shares of Preferred Stock | |||||||||||||||

| Voting and/or Investment Power | Total Shares | |||||||||||||||

Name and Address(1) | Sole | Shared | ||||||||||||||

F. Quinn Stepan(4) | 22,162 | 166,480 | (3) | 188,642 | 36.2 | % | ||||||||||

Stepan Venture II | 0 | 166,480 | (3) | 166,480 | 32.0 | % | ||||||||||

Mary Louise Wehman(4) | 89,684 | 89,684 | 17.2 | % | ||||||||||||

John A. Stepan(4) | 76,872 | 76,872 | 14.7 | % | ||||||||||||

Charlotte Stepan Shea(4) | 35,244 | 35,244 | 6.7 | % | ||||||||||||

| (1) |

| Represents number of shares beneficially owned as of March |

6

| Includes the number of shares of Common Stock that the specified person has the right to acquire by conversion of shares of Preferred Stock beneficially owned by such person. |

| As reported in a Schedule |

| The address for Mr. Stepan is Stepan Company, Edens Expressway and Winnetka Road, Northfield, Illinois 60093. |

| (5) | Includes (a) 94,631 shares of Common Stock allocated to Mr. Stepan under ESOP II, (b) 403,390 shares of Common Stock credited to Mr. Stepan’s stock account under the Management Incentive Plan, (c) 61,106 shares which Mr. Stepan has the right to acquire within 60 days through the exercise of stock options granted pursuant to the Company’s incentive compensation plans, and (d) 308,548 shares of Common Stock pledged as security for three bank loan agreements. |

| (6) | Mr. Stepan and his brother, Paul H. Stepan, are managing partners of a family-owned limited partnership that is the sole general partner of another family-owned limited partnership, Stepan Venture II, which owns 530,542 shares of Common Stock. The partnership has pledged a total of 507,409 shares of Common Stock as security for two bank loan agreements. The shares owned by the partnership are included in the table for Mr. Stepan. |

| (7) | As reported in a Schedule 13G/A filed with the SEC on February |

| (8) | As reported in a Schedule 13G filed with the SEC on February 11, 2013, by The Vanguard Group, Inc. (“Vanguard”), an investment adviser, 100 Vanguard Boulevard, Malvern, Pennsylvania, 19355. In the Schedule 13G, Vanguard reported that, as of December 31, 2012, it had sole voting power as to 22,810 shares, sole dispositive power as to 1,142,382 shares, and shared dispositive power as to 22,210 shares. |

6

Security Ownership of Management

The following table sets forth, as of the close of business on March 4, 2011,1, 2013, the security ownership of each Executive Officer listed in the Summary Compensation Table in this proxy statement, each Director and nominee for Director, and all Directors and Executive Officers as a group:

Name | Number and Percent of Shares of Common Stock Beneficially Owned(1) | Number and Percent of Shares of Common Stock Beneficially Owned(1) | ||||||||||||||

James E. Hurlbutt | 369,069 | (2) | 3.4 | % | 608,847 | (2) | 2.7 | % | ||||||||

Scott C. Mason | 27,839 | (3) | * | |||||||||||||

John V. Venegoni | 49,355 | (3) | * | 41,196 | (4) | * | ||||||||||

Robert J. Wood | 48,420 | (4) | * | |||||||||||||

F. Quinn Stepan | 1,609,458 | (5) | 14.9 | % | 1,771,429 | (5) | 8.0 | % | ||||||||

F. Quinn Stepan, Jr | 791,837 | (6) | 7.3 | % | 1,353,966 | (6) | 6.1 | % | ||||||||

Michael R. Boyce | 333 | (7) | * | 3,669 | (7) | * | ||||||||||

Randall S. Dearth | 1,270 | (8) | * | |||||||||||||

Joaquin Delgado | 0 | (8) | * | 2,114 | (9) | * | ||||||||||

Thomas F. Grojean | 20,004 | (9) | * | |||||||||||||

Gary E. Hendrickson | 3,458 | (10) | * | |||||||||||||

Gregory E. Lawton | 7,465 | (11) | * | 18,052 | (10) | * | ||||||||||

Edward J. Wehmer | 12,530 | (12) | * | 28,216 | (11) | * | ||||||||||

All Directors and Executive Officers(13) | 2,686,565 | 24.9 | % | |||||||||||||

All Directors and Executive Officers(12) | 3,567,538 | 16.1 | % | |||||||||||||

* Less than one percent of outstanding shares of Common Stock.

| (1) | Number of shares for each Director, nominee for Director, and Executive Officer (and all Directors and Executive Officers as a group) includes (a) shares of Common Stock owned by the spouse of each Director, nominee for Director, or Executive Officer, and shares held by each Director, nominee for Director, or Executive Officer, or such person’s spouse as trustee or custodian for the benefit of children and family members if such trustee or custodian has voting or investment power, (b) shares of Common Stock that may be acquired within 60 days through the exercise of stock options granted pursuant to the Company’s |

| (2) | Includes (a) |

7

a Trust Agreement effective |

| (3) | Includes (a) |

| (4) | Includes (a) 9,779 shares of Common Stock allocated to John V. Venegoni under ESOP II, and |

| (5) | See Note |

| (6) | See Notes (3) and (4) to table under Directors Whose Terms Continue. |

| (7) | See Note (2) to table under Nominees for Director. |

| (8) | See table under Directors Whose Terms Continue. |

| (9) |

| (10) | See Note |

| (11) | See Note (4) to table under |

7

| (12) |

| As of March |

Equity Compensation Plan Information

The following table provides information as of December 31, 2010,2012, about the Company’s securities that may be issued under the Company’s existing equity compensation plans, all of which have been approved by the stockholders:

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column(a)) | ||||||||||||||||||

| (a) | (b) | (c) | (a) | (b) | (c) | |||||||||||||||||||

Equity compensation plans approved by security holders | 679,128 | $ | 32.44 | 278,143 | (1) | 748,810 | $25.76 | 2,401,590(1) | ||||||||||||||||

Equity compensation plans not approved by security holders | — | — | — | — | — | — | ||||||||||||||||||

Total | 679,128 | $ | 32.44 | 278,143 | 748,810 | $ | 25.76 | 2,401,590 | ||||||||||||||||

| (1) | Under the Company’s existing equity compensation plans, shares may be issued in the form of performance stock awards as awarded by the Compensation and Development Committee of the Board of Directors. |

8

SectionSECTION 16(a) Beneficial Ownership Reporting ComplianceBENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 and the rules thereunder require the Company’s Executive Officers and Directors, and persons who own more than 10 percent of the Common Stock or Preferred Stock, to file reports of beneficial ownership and changes in beneficial ownership of Common Stock or Preferred Stock with the SEC, the New York Stock Exchange, the Chicago Stock Exchange and the Company.SEC. Based solely upon a review of such reports filed with the copies of such forms received by it during or with respect to its most recent fiscal year, orSEC and written representations from certain reporting persons, the Company believes that all such required reports have been timely filed except for four late reports for four transactions by each of the followingtwo Company Executive Officers: Messrs. F. Quinn Stepan, F. Quinn Stepan, Jr., James E. Hurlbutt, Gregory Servatius, John V. Venegoni, Robert J. Wood, and H. Edward Wynn. These late reports were caused by a minor administrative error which has been corrected for reporting deferred quarterly dividend equivalents pursuant to a new 2010 incentive compensation plan. All such transactions have since been properly reported. In addition,Officers. Mr. Frank Pacholec filed one late report for twelve transactions occurring during 2005, 2006 and 2007 due to inadvertent omissions of the reporting of ten dividend reinvestment purchases of Common Stock and two purchases of Common Stock in 2006, which were all reported on a Form 4 upon discovery of the omissions. Mr. H. Edward Wynn filed one late report for two transactions due to an inadvertent omission of the reporting of two transactions eachdividend reinvestment purchases of Common Stock in both 2009 and 20102008 which were also filed by Mr. F. Quinn Stepan due to minor administrative errors which have been corrected to comply withreported on a Form 4 upon discovery of the minimum required distribution rules for the Company’s two Employee Stock Ownership Plans. All such transactions have since been properly reported.omissions.

8

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Policies and Procedures for Approving Related Person Transactions

The Company adopted a written policy entitled “Stepan Company Related Party Transactions Policy and Procedures” which was initially approved by the Audit Committee of the Board of Directors in February 2007, and has been annually reviewed by the Audit Committee at each subsequent February meeting (“Related Party Transactions Policy”). This policy applies to transactions (“Related Party Transactions”) involving the Company and a Related Party, which is defined as a person or entity who is a Company executive officer, Director, or nominee for election as a Director, or a beneficial owner of 5% or more of the Company’s stock, or an immediate family member of these persons. The Related Party Transactions Policy states that the Company will enter into or ratify Related Party Transactions only when the Board of Directors, acting through the Audit Committee or as otherwise set forth in the Related Party Transactions Policy, approves the Related Party Transaction after determining that it is in, or is not inconsistent with, the best interests of the Company and its stockholders. The Audit Committee will review the material facts of all Related Party Transactions underpursuant to the Related Party Transactions Policy, as discussed below, in order to make such determination and to decide whether to approve or disapprove such Related Party Transaction. No Director may participate in any discussion orinvolving the approval of a Related Party Transaction for which he or she is a Related Party, except that the Director must provide any material information concerning the Related Party Transaction requested by the Audit Committee.

As set forth in the Related Party Transactions Policy, the Audit Committee has reviewed and approved certain types of Related Party Transactions and determined that the following types of Related Party Transactions will be generally deemed to be pre-approved under the terms of the Related Party Transactions Policy without further review by the Audit Committee: employment of executive officers; director compensation/reimbursement; transactions where all employees or stockholders receive proportional benefits; transactions with another company at which a Related Party’s only relationship is as an employee (other than as an executive officer) or director of that company or beneficial owner of less than 10% of that company’s shares, if the aggregate amount involved does not exceed the greater of $1 million or 2% of that company’s total annual revenues; and certain Company charitable contributions to charitable or non-profit organizations if the Related Party’s only relationship is as an employee (other than as an executive officer) or a director or acting in a similar capacity at that organization, if the aggregate amount involved does not exceed the greater of $1 million or 2% of that organization’s total annual receipts. In addition, the Board of Directors has delegated to the Audit Committee Chairman the authority to approve or ratify any Related Party Transaction with a Related Party in which the aggregate amount involved is expected to be less than $120,000. All other Related Party Transactions must be approved by the Audit Committee pursuant to the procedures discussed below.

9

At each calendar year’s first regularly scheduled Audit Committee meeting, the Company’s management will submitsubmits for the Audit Committee’s consideration any proposed Related Party Transaction it would like the Company to enter into during that calendar year, including the proposed aggregate value of such transaction, as applicable. After the first calendar year meeting, any additional proposed Related Party Transactions must be submitted to the Audit Committee for approval. If the Audit Committee determines that a proposed transaction exceeds $120,000 and is a Related Party Transaction that requires review and approval by the Audit Committee, the proposed Related Party Transaction and relevant factors will beare reviewed by the Audit Committee. SuchRelevant factors considered by the Audit Committee forin its evaluation of a Related Party Transaction include the Related Party’s relationship to the Company and the Related Party’s interest in the transaction; the material facts of the proposed Related Party Transaction, including the proposed aggregate value of the transaction; the benefits to the Company of the proposed Related Party Transaction; if applicable, the availability of other sources of comparable products or services; and an assessment of whether the terms of the proposed Related Party Transaction are comparable to the terms available to an unrelated third party or to employees generally, as applicable. For ongoing transactions, the Audit Committee will taketakes into consideration the Company’s contractual obligations under the transactions and, based on all available relevant facts and circumstances, determinedetermines if the Related Party Transaction remains in the best interests of the Company and its stockholders. After review, the Audit Committee will approveapproves or disapprovedisapproves such transactions and at each subsequently scheduled meeting, the Company will updateupdates the Audit Committee as to any material change to those transactions.

9

In the event the Company’s Chief Executive Officer, Chief Financial Officer or General Counsel becomes aware of a Related Party Transaction that has not been previously approved or ratified underpursuant to the Related Party Transactions Policy pursuant to the above procedures, if the transaction is pending, it will beis submitted to the Audit Committee promptly for its review based on the factors above. Based on its conclusions, the Audit Committee will evaluateevaluates all options, including ratification, amendment or termination of the Related Party Transaction. If the transaction is ongoing or has been completed, the Audit Committee will evaluateevaluates the transaction, taking into account the same factors described above, to determine if rescission of the transaction is appropriate and will requestrequests that the General Counsel evaluate the Company’s controls and procedures to determine why the transaction was not submitted to the Audit Committee for prior approval pursuant to the Related Party Transactions Policy and whether any changes to these procedures are recommended.

Transactions with Related Persons, Promoters and Certain Control Persons

Mr. Richard Stepan (son of F. Quinn Stepan and brother of F. Quinn Stepan, Jr.) is a current Company employee at the Company’s Millsdale,Northfield, Illinois facility.offices. Mr. Richard Stepan is neither a Company officer nor a Director or nominee for Director. As an employee of the Company, Mr. Richard Stepan receives a base salary, short-term incentive compensation as appropriate for his position, and other regular and customary employee benefits generally available to all Company employees. With respect to fiscal 2010,2012, Mr. Richard Stepan was paid a base salary of $128,750,$143,390, bonus/incentive compensation of $19,838, and certain relocation expenses under the Company’s relocation program of $6,990,$14,596, and participated in other regular and customary employee benefit programs generally available to all Company employees. Pursuant to the Company’s Related Party Transactions Policy, the Audit Committee has reviewed this transaction and has determined that it is in the best interests of the Company and its stockholders to permit the Company to continue to employ Mr. Richard Stepan. Accordingly, the Audit Committee has approved this transaction under the Related Party Transactions Policy pursuant to the procedures described above.

10

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS

Corporate Governance Guidelines and Code of Conduct

The Company is committed to having sound corporate governance principles and has adopted Corporate Governance Guidelines and a Code of Conduct to maintain those principles. The Company’s Code of Conduct applies to all of the Company’s officers, directors and employees, including the Company’s PrincipalChief Executive Officer and PrincipalChief Financial Officer. The Company’s Corporate Governance Guidelines and Code of Conduct are available at http://www.stepan.com, under “Investors – “Investor Relations—Corporate Governance.” Stockholders may also request a free printed copy of the Company’s Corporate Governance Guidelines and Code of Conduct by contacting the Company’s Secretary at Stepan Company, Secretary’s Office, Edens Expressway and Winnetka Road, Northfield, Illinois 60093.

Board Committees

The Board of Directors has a standing Audit Committee, Compensation and Development Committee, and Nominating and Corporate Governance Committee. All three committees are composed entirely of independent directors in accordance with the rules of the New York Stock Exchange and as described below under “Director Independence.”

| • | Audit Committee |

The Audit Committee held seveneight meetings in 2010.2012. The responsibilities of the Audit Committee include annual selection and engagement of the Company’s independent registered public accounting firm, meeting with the Company’s independent registered public accounting firm before the year-end audit to review the proposed fees and scope of work of the audit, meeting with the Company’s independent registered public accounting firm at the completion of the year-end audit to review the results of the audits of the Company’s financial statements and internal control over financial reporting, meeting with the Company’s independent registered public accounting firm prior to the Company’s filing of each quarterly report on Form 10-Q and the annual report on Form 10-K, review of the independent registered public accounting firm’s communication setting forth findings and suggestions regarding internal controls, financial policies and procedures and management’s response to that communication, review of the internal audit program of the Company, review of unusual or significant financial transactions, review and approval or disapproval of Related Party Transactions pursuant to the Company’s Related Party Transactions Policy, and preparation of an Audit Committee report as required by the SEC to be included in this proxy statement.

The members of the Audit Committee in 20102012 were Messrs. Michael Boyce, Dearth (elected April 20, 2010)24, 2012), Thomas Grojean, Gary Hendrickson, GregoryDelgado, Lawton Robert Potter (retired April 20, 2010) and Edward Wehmer (Chairman), all of whom are independent directors in accordance with the rules of the New York Stock Exchange and the SEC and as described below under “Director Independence.” The Board of Directors has determined that Mr. Wehmer is qualified as an Audit Committee financial expert within the meaning of SEC regulations. In addition, the Board of Directors has determined that Mr. Wehmer has accounting and related financial management expertise within the meaning of the rules of the New York Stock Exchange. None of the Audit Committee members serve on the audit committee of more than two public companies.

The report of the Audit Committee is included in this proxy statement. The charter of the Audit Committee is available at http://www.stepan.com, under “Investors—“Investor Relations – Corporate Governance.” Stockholders may also request a free printed copy of the charter by contacting the Company’s Secretary at Stepan Company, Secretary’s Office, Edens Expressway and Winnetka Road, Northfield, Illinois 60093.

11

| • | Compensation and Development Committee |

The Compensation and Development Committee held three meetings in 2010.2012. The responsibilities of the Compensation and Development Committee include reviewing and, if appropriate, adjusting the salaries of the executive officers of the Company each year,annually, approving all management incentive awards, approving proposed

11

grants of stock awards, providing advice to the Company regarding executive development and succession planning, approving the Company’s Compensation Discussion and Analysis, and preparing the Compensation and Development Committee Report as required by the SEC to be included in this proxy statement. The members of the Compensation and Development Committee in 20102012 were Messrs. Michael Boyce, Dearth (elected April 20, 2010)24, 2012), Thomas Grojean, Gary Hendrickson, GregoryDelgado, Lawton (Chairman), Robert Potter (retired April 20, 2010) and Edward Wehmer, all of whom are independent directors in accordance with the rules of the New York Stock Exchange and as described below under “Director Independence.”

Both the Compensation Discussion and Analysis and the Compensation and Development Committee Report are included in this proxy statement. The charter of the Compensation and Development Committee is available at http://www.stepan.com, under “Investors—“Investor Relations – Corporate Governance.” Stockholders may also request a free printed copy of the charter by contacting the Company’s Secretary at Stepan Company, Secretary’s Office, Edens Expressway and Winnetka Road, Northfield, Illinois 60093.

| • | Nominating and Corporate Governance Committee |

The Nominating and Corporate Governance Committee held three meetings in 2010.2012. The responsibilities of the Nominating and Corporate Governance Committee include assisting the Board of Directors by identifying individuals qualified to become board members and recommending to the Board of Directors the Director nominees for election to the next annual meetingBoard of stockholders,Directors, developing and recommending to the Board of Directors the guidelines for corporate governance applicable to the Company, leading the Board of Directors in its annual review of the Board of Directors’ performance, and recommending to the Board of Directors the Directorsmembers for each Board committee.

The members of the Nominating and Corporate Governance Committee in 20102012 were Messrs. Michael Boyce (Chairman), Dearth (elected April 20, 2010)24, 2012), Thomas Grojean, Gary Hendrickson (Chairman effective April 20, 2010), GregoryDelgado, Lawton Robert Potter (Chairman until his retirement on April 20, 2010) and Edward Wehmer, all of whom are independent directors in accordance with the rules of the New York Stock Exchange and as described below under “Director Independence.” The charter of the Nominating and Corporate Governance Committee is available at http://www.stepan.com, under “Investors—“Investor Relations—Corporate Governance.” Stockholders may also request a free printed copy of the charter by contacting the Company’s Secretary at Stepan Company, Secretary’s Office, Edens Expressway and Winnetka Road, Northfield, Illinois 60093.

The Nominating and Corporate Governance Committee reports annually to the Board of Directors onreports an assessment of the Board of Directors’ performance.performance to the Board of Directors. The Chairman of the Nominating and Corporate Governance Committee initially discusses the assessment with the Chairman, and if desired by any Director, the assessments are also discussed at the Executive Sessions of the non-management Directors. This assessment evaluates the Board of Directors’ contribution to the Company in its entirety and reviews areas in which the Board of Directors and/or management believe a stronger contribution could be made. The Nominating and Corporate Governance Committee is responsible for evaluating the performance of current members of the Board of Directors at the time they are considered for re-nomination to the Board of Directors.

Board Meetings and Attendance

During 2010,2012, there were five regular meetings and one special meeting of the Board of Directors. During 2010,2012, all of the Directors attended greater than 75 percent of the total number of meetings of the Board of Directors and the meetings of committees of the Board of Directors of which each Director was a member. The

12

While all Directors are encouraged to attend, the Company does not have a formal policy regarding Directorrequiring attendance at the Company’s Annual Meeting of Stockholders. All Directors attended the 20102012 Annual Meeting of Stockholders and planare currently expected to attend the 20112013 Annual Meeting of Stockholders.

Director Nomination Process

It is the policy of the Nominating and Corporate Governance Committee to consider properly submitted stockholder nominations for candidates for membership on the Board of Directors. In evaluating such

12

nominations, the Nominating and Corporate Governance Committee seeks to achieve a balance of knowledge, experience and capability on the Board of Directors to address the membership criteria. Any stockholder nominations proposed for consideration by the Nominating and Corporate Governance Committee must comply with the requirements set forth in the Company’s By-laws. Among other things, a stockholder must give written notice containing the information required by the Company’s By-laws to the Secretary of the Company at Stepan Company, Secretary’s Office, Edens Expressway and Winnetka Road, Northfield, Illinois 60093. The deadline to submit a director nomination for next year’s annual meetingthe 2014 Annual Meeting of stockholdersStockholders is set forth in the “Stockholder“2014 Stockholder Proposals” section below. The Secretary delivers all correspondence to the Nominating and Corporate Governance Committee Chairman without first screening the correspondence.

The Corporate Governance Guidelines contain the Board of Directors’ membership criteria that apply to nominees recommended by the Nominating and Corporate Governance Committee for a position on the Board of Directors. Under these criteria, members of the Board of Directors should possess qualities that include strength of character, an inquiring and independent mind, practical wisdom and mature judgment. In addition to these qualities, Director nominees should also possess recognized achievement, an ability to contribute to some aspect of the Company’s business, and the willingness to make the commitment of time and effort required of a Director. The Nominating and Corporate Governance Committee’s process for identifying and evaluating Director nominees for Director includes recommendations by stockholders, non-management Directors and executive officers, a review and background check of specific candidates, an assessment of the candidate’s independence under the director independence standards described below, and interviews of Director candidates by the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee’s evaluation of a nominee recommended by a stockholder would consider the general criteria and required information previously described in this section, and any other factors the Nominating and Corporate Governance Committee deems relevant.

Dr. Joaquin Delgado is a nominee for DirectorEach of Messrs. Boyce, Stepan and Wehmer are current Directors who has not been previously elected by the stockholders. At the direction of the Nominating and Corporate Governance Committee, an executive search firm was retained to help identify and facilitate the screening and interview process of candidates for Director. Dr. Delgado was identified by the search firm as a potential Director candidate. Dr. Delgado was subsequently interviewed by members of the Nominating and Corporate Governance Committee. Based on all of these factors, it was determined by the Nominating and Corporate Governance Committee that Dr. Delgado possesses the qualities, achievements, experience and capabilities necessary to serve as a Company Director. Mr. F. Quinn Stepan, Jr. is a current Director who waswere previously elected by the stockholders. The term for Mr.each of Messrs. Boyce, Stepan Jr.and Wehmer expires in 2011.2013. The nominations of Messrs. DelgadoBoyce, Stepan and Stepan, Jr.Wehmer to stand for election for a three-year term at the 20112013 Annual Meeting of Stockholders have each been reviewed and approved by the Nominating and Corporate Governance Committee and the Board of Directors.

Board Diversity

The Board of Directors does not have a formal policy with respect to diversity. However, in identifying Director nominees, the Nominating and Corporate Governance Committee and the Board of Directors consider a broad definition of diversity, including but not limited to, diversity of professional experience, education and skills. For example, the Nominating and Corporate Governance Committee and the Board of Directors have

13

considered operational experience, international experience, technical experience, financial experience, and experience related to the Company’s current product lines and industries. If the Nominating and Corporate Governance Committee utilizes an outside search firm to identify Director nominees, it instructs the search firm to consider broadly-defined diversity in identifying potential nominees.

Director Independence

For purposes of determining director independence, the Company has adopted the following standards in compliance with the New York Stock Exchange director independence standards as currently in effect. No Director qualifies as “independent” unless the Board of Directors affirmatively determines that the Director has no material relationship with the Company or any of its subsidiaries (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company or any of its subsidiaries). In addition, a Director is not independent if:

The Director is, or has been within the last three years, an employee of the Company, or an immediate family member is, or has been within the last three years, an executive officer of the Company;

13

The Director, or an immediate family member, has received, during any twelve-month12-month period within the last three years, more than $120,000 in direct compensation from the Company, other than Director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service);

(A) The Director is a current partner or employee of a firm that is the Company’s internal or external independent registered public accounting firm; (B) the Director has an immediate family member who is a current partner of such a firm; (C) the Director has an immediate family member who is a current employee of such a firm and personally works on the Company’s audit; or (D) the Director or an immediate family member was within the last three years a partner or employee of such a firm and personally worked on the Company’s audit within that time;

The Director or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of the Company’s present executive officers at the same time serves or served on that company’s compensation committee; or

The Director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million or 2% of such other company’s consolidated gross revenues.

Under the New York Stock Exchange rules and the Company’s Corporate Governance Guidelines, at least a majority of the Company’s Directors and each member of the Audit Committee, Compensation and Development Committee, and Nominating and Corporate Governance Committee must meet the independence standards set forth above. The Board of Directors has determined that each of Messrs. Michael R. Boyce, Gary E. Hendrickson,Randall S. Dearth, Joaquin Delgado, Gregory E. Lawton and Edward J. Wehmer has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company) and is independent under the standards set forth above. In addition, the Board of Directors has also determined that Joaquin Delgado, a nominee for Director, has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company) and would be deemed independent under the standards set forth above should he be elected by the stockholders as a Director of the Company at the 2011 Annual Meeting of Stockholders.

Mr. F. Quinn Stepan and Mr. F. Quinn Stepan, Jr. are not deemed independent under the rules of the New York Stock Exchange since Mr. F. Quinn Stepan has served as the Chairman of the Company since November 1984 and Mr. F. Quinn Stepan, Jr. has served as the President and Chief Executive Officer of the Company since January 2006.

14

Board Leadership Structure

The Board of Directors regularly reviews its leadership structure in light of the Company’s then current needs, trends, internal assessments of Board effectiveness, and other factors. The Board of Directors does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board as the Board believes it is in the best interests of the Company currentlyto make that determination based on the position and direction of the Company and the membership of the Board. At this time, the Company separates the Chief Executive Officer and Chairman positions. The positions have been separate since 2006.Company’s Chief Executive Officer is generally responsible for the Company’s day-to-day operations and strategic planning. In addition to chairing the Board of Directors, the Chairman provides strategic advice based on his extensive industry experience and knowledge of the Company’s operations. The Board of Directors believes that this structure is appropriate atit benefits from the current time because it enables the Company to retain on the Board of Directors theChairman’s experience and perspectives of a major shareholderexpertise in the Company’s industry and former Chief Executive Officer,business, as well as the skills and talentsChief Executive Officer’s understanding of the current Chief Executive Officer. TheCompany’s ongoing operations.

While the Board of Directors does not have a Lead Director.Director, the independent directors regularly meet in Executive Sessions without the Chairman, the Chief Executive Officer or management present in accordance with the Company’s Corporate Governance Guidelines.

14

Director Qualifications

All Directors and nominees for Director possess strong executive leadership experience based on their individual experience from their positions as executives of various corporations. Certain individual qualifications and skills of each Director and nominee for Director that were considered in nominating such individual to the Board of Directors are as follows:

Mr. F. Quinn Stepan: Mr. Stepan has served as Chairman of the Company since 1984. In his over 50-year career with the Company, Mr. Stepan has held numerous positions, including Chief Executive Officer. Mr. Stepan’s experience as the former Chief Executive Officer provides the Board of Directors with extensive knowledge of the Company’s history and its operations and strategy.

Mr. F. Quinn Stepan, Jr.: Mr. Stepan, Jr. serves as the President and Chief Executive Officer of the Company, a position he has held since 2006. In his over 25-year career with the Company, Mr. Stepan, Jr. has served in a number of positions of increasing responsibility and in a variety of functions within the Company’s operations. Mr. Stepan, Jr. also serves as a director for another company. Mr. Stepan, Jr.’s day-to-day strategic leadership provides the Board of Directors with extensive knowledge of the Company’s operations.

Mr. Michael R. Boyce: Mr. Boyce is the Chairman and Chief Executive Officer of PQ Corporation, an industrial chemicalsa global specialty chemical and catalyst company, as well as the Chairman and Chief Executive Officer of Peak Investments, an operating and acquisition company. Mr. Boyce also serves as a director for other companies.PQ Corporation and AAR Corp. Mr. Boyce also provides the Board of Directors with global executive leadership in the chemical industry as well as expertise in strategic business matters.

Mr. Randall S. Dearth: Mr. Dearth is the President and Chief Executive Officer of Calgon Carbon Corporation, a global manufacturer of activated carbon and innovative treatment systems. Mr. Dearth also serves as a director for Calgon Carbon Corporation. Prior to Calgon Carbon, Mr. Dearth served as the President and Chief Executive Officer of LANXESS Corporation, a global chemicals manufacturer. Mr. Dearth provides the Board of Directors with global executive leadership in the chemical industry and a global perspective on European leadership, strategy and business conditions.

Dr. Joaquin Delgado: Dr. Delgado is the Executive Vice President, Electro and CommunicationsHealth Care Business Group of 3M Company, a global diversified technology company. Dr. Delgado is a current nominee for Director and will, if elected by the stockholders, providehas also held other executive leadership positions at 3M. Dr. Delgado provides the Board of Directors with expertise in innovation and current global business and operational experience.

Mr. Thomas F. Grojean: Mr. Grojean is the Chairman and Chief Executive Officer of Grojean Transportation, a nationwide truckload freight carrier. Mr. Grojean has extensive experience in the transportation industry and is also a Certified Public Accountant. Mr. Grojean has been a Director of the Company for more than 30 years, and provides the Board of Directors with operational expertise in a related industry and experience with the Company’s operations. Mr. Grojean will be retiring from the Board of Directors effective May 3, 2011.

Mr. Gary E. Hendrickson: Mr. Hendrickson is the President and Chief Operating Officer of The Valspar Corporation, a global paint and coatings manufacturer, where he is also a member of Valspar’s Board of Directors. At Valspar, Mr. Hendrickson has served in a variety of senior management roles, including as a regional executive in Asia Pacific. Mr. Hendrickson provides the Board of Directors with a global perspective and current operational experience.

Mr. Gregory E. Lawton: Mr. Lawton is the former President and Chief Executive Officer of JohnsonDiversey, a leading global provider of cleaning and hygiene solutions to the institutional and industrial marketplace. Mr. Lawton previously held various leadership roles at other companies and also serves as a director for other companies.General Cable and American Trim. Mr. Lawton provides the Board of Directors with global expertise and executive leadership from the consumer products industry, and extensive experience with employee development.

15

|

Mr. Edward J. Wehmer: Mr. Wehmer is the President and Chief Executive Officer of Wintrust Financial Corporation, a financial services company. Mr. Wehmer is also a Certified Public Accountant.Accountant and serves as a director for Wintrust Financial Corporation. Mr. Wehmer provides the Board of Directors with expertise in strategic, financial, banking and accounting matters. Mr. Wehmer also has extensive experience with acquisitions.

Risk Management

The Board of Directors takes an active role in overseeing the Company’s financial and non-financial risks. The Audit Committee, which is chaired by Mr. Wehmer, an Audit Committee financial expert, takes a lead role in overseeing Company risks. The Audit Committee receives reports from the Company’s Director of Internal Audit, the Chief Financial Officer, and the General Counsel, all of whom are responsible for various aspects of the Company’s risk management. The Director of Internal Audit reports directly to the Audit Committee. The Audit Committee meets with the Company’s external auditors, separately from management.

15

The Compensation and Development Committee, which is chaired by Mr. Lawton, takes the lead role in overseeing the management of risks as they relate to the Company’s compensation policies and practices. For 2010,2012, the Compensation and Development Committee reviewed these compensation policies and practices and did not identify any risks that are reasonably likely to have a material adverse effect on the Company.

Executive Sessions

Executive Sessions of non-management Directors will beare held at least two times per year. At least one of the Executive Sessions each year will beis limited to the Company’s independent Directors. Executive Sessions are generally held by the independent Directors after every regular Board of Directors meeting and after most Board committee meetings. In 2010, three Executive Sessions were held by the independent Directors and chaired by Mr. Hendrickson. In addition, Executive Sessions were also held after most Board committee meetings during 2010 and were chaired by the respective chairman of the Board committee. The Executive Sessions after all regular Board of Directors meetings are scheduled and chaired by the Chairman of the Nominating and Corporate Governance Committee. Effective February 2011, Mr. Boyce serves as the Chairman of the Nominating and Corporate Governance Committee. Any non-management Director can request that an additional Executive SessionSessions be scheduled. In 2012, four Executive Sessions without management were held by the independent Directors and chaired by Mr. Boyce. In addition, Executive Sessions were also held after most Board committee meetings during 2012 and were chaired by the respective chairman of the Board committee.

Communication with the Board

A stockholder may communicate with the Board of Directors by writing c/o Secretary’s Office, Stepan Company, Edens Expressway and Winnetka Road, Northfield, Illinois 60093. Mail addressed to a specific Director or CommitteeBoard committee will be delivered to that Director or Committee.Board committee. The Secretary delivers all correspondence without first screening the correspondence.

Compensation Committee Interlocks and Insider Participation

None

16

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

RoleSummary of theExecutive Compensation and Development Committeein 2012

TheIn 2012, the Company and the Compensation and Development Committee of the Board of Directors (defined within this Compensation Discussion and Analysis section as the “Committee”) applied the compensation policies and principles described in this Compensation Discussion and Analysis in determining compensation for the individuals named in the Summary Compensation Table. Those individuals are referred to herein as the named executive officers (“NEOs”). Specifically:

Base salary was surveyed and determined to be consistent with similar positions in similar industries.

Incentive pay was directly connected to Company and individual performance, and reflected record Company financial performance.

All NEOs were in compliance with the Company’s stock ownership requirements.

In most cases, the types of compensation and benefits provided to the NEOs by the Company are the same as those provided to the Company’s other executives. The limited amount of benefits and perquisites offered to the NEOs is common to many companies and was reasonable in both nature and amount. The Company believes it needed to offer the level of 2012 executive compensation, benefits and perquisites as part of its total reward components to attract, motivate and retain talented executives in a competitive staffing environment. After considering all components of the total compensation paid to the NEOs in 2012, the Committee has determined that the 2012 NEO compensation was competitive and reasonable.

For the second consecutive year, the Company’s advisory Say-on-Pay vote was overwhelmingly supported by the stockholders with the approval of over 90% of those stockholders present at the 2012 Annual Meeting of Stockholders in person or by proxy. The Company and the Committee will continue to review and consider the results of the Say-on-Pay vote and value stockholder input on the Company’s compensation program and philosophy.

Role of the Compensation and Development Committee

The Committee is responsible for overseeing the establishment and administration of the Company’s policies, programs and procedures for compensating the Company’s executive management, as further described below. The Committee is also responsible for providing advice to the Company regarding executive development and succession planning. The Committee acts pursuant to a charter, which is available on the Company’s website at http://www.stepan.com, under “Investors—“Investor Relations—Corporate Governance.”

The individuals who served as the Company’s Principal Executive Officer and Principal Financial Officer during fiscal year 2010, as well as the Company’s three other most highly compensated executive officers during fiscal year 2010 included in the Summary Compensation Table, are referred to in this proxy statement as the named executive officers (“NEOs”). The executive officers include the NEOs and the other executive officers of the Company.

Compensation Objectives

The overall objectives of the Company’s compensation programs are as follows:

motivate employees to achieve and maintain a high level of performance, and drive results that will help the Company achieve its goals;

align the interests of our employees with the interests of our stockholders;

provide for levels of compensation that are competitive with the marketplace; and

attract and retain employees of outstanding ability.

17

Compensation Philosophy

The basic premise of the Company’s executive compensation philosophy is to pay for performance. The Company’s intention is to foster a performance-driven culture with competitive total compensation as a key driver for all employees. Compensation levels commensurate with Company performance align the interests of itsour employees with the interestinterests of itsour stockholders.

The Company’s guiding philosophy in setting executive compensation is that the compensation of executive officers should reflect the scope of their job responsibilities and level of individual and corporate performance achieved. Executive compensation should be competitive internally, as well as externally, to like or comparable positions based on job descriptions and responsibilities at similarly sized companies within general industry and/or the chemical industry,Company’s industries and other appropriate related industry benchmarks or survey information. The Company’s compensation philosophy is reviewed at least annually by the Committee.

The effectiveness of the executive compensation program is primarily measured by Company performance, stock price appreciation, the ability of the Company to attract and retain executive officers, and comparison against other relevant, external benchmarks as needed.

The Committee generally does not consider the impact of previously awarded compensation in determining current executive total compensation. The Committee does, however, use both aggregate general industry survey data as well as a chemical industry peer group to benchmark executive compensation annually as described

17

below under “Benchmarking“Use of Industry Surveys and Peer Group Data.” Except for the limits regarding incentive compensation as described below, the Committee does not use specific policies to allocate between cash and non-cash compensation or between short-term and long-term compensation.

Compensation Consultant

The Committee has not retained its own consultant to provide overall compensation advice. However, in the event the Committee does retain a compensation consultant, the Committee will consider the relevant factors necessary to determine the consultant’s independence and whether their work raises any conflicts of interest. On an ongoing basis, the Committee and the Company utilize compensation survey data and software purchased from a compensation consultant, Towers Watson, when making base compensation decisions for Company executives. The Committee and the Company also receive long-term incentive survey data from Towers Watson annually as well as total compensation benchmark information.

Compensation Consultant Fees

The aggregate fees paid by the Company for all services provided by compensation consultants, including services provided by Towers Watson, did not exceed $120,000 for the year ended December 31, 2010.2012.

Role of Executives in Establishing Compensation

The Committee determines the compensation of the Chairman and the Chief Executive Officer. The Chief Executive Officer and the Vice President—Human Resources make recommendations to the Committee regarding compensation for all other executive officers, including the NEOs. The Committee then reviews these recommendations and approves the final compensation for these individuals. All recommendations made to the Committee and all determinations made by the Committee are based upon the Company’s policies and guidelines and other relevant factors outlined in the “Benchmarking“Use of Industry Surveys and Peer Group Data” and “Elements of Compensation” sections below.

The advisory vote in 2012 was the second consecutive year that the Company’s Say-on-Pay vote was overwhelmingly supported by the stockholders with the approval of over 90% of those stockholders present at the 2012 Annual Meeting of Stockholders in person or by proxy. The Committee acknowledges and values the

18

feedback from the Company’s stockholders on the annual Say-on-Pay vote and believes that these results demonstrate stockholder support of the Company’s overall executive compensation approach, which is primarily designed as performance-based and aligned with stockholders’ interests. The Committee considered and will continue to consider the outcome of these advisory votes when determining future executive compensation arrangements.

BenchmarkingUse of Industry Surveys and Peer Group Data

The Company determines compensation by considering two sources: industry surveys and compensation information from a select group of peer companies. The Company reviews survey data for total compensation, including base salary, short-term incentives and long-term incentives, annually or otherwise periodically, as appropriate.

The Company subscribes to compensation survey data supplied by Towers Watson for the purpose of comparing total compensation. For the executive officers, including the NEOs, the Company reviews compensation using the Towers Watson 2012 Compensation Data Bank General Industry Executive Compensation Survey Report on Top Management Compensation. The Towers Watson Survey Report on Top Management CompensationReport—U.S. This report is comprised of data from more than 1,600435 organizations representing a variety of industries, sizes of companies and geographic areas. The Company utilizes survey data for the position or positions that most closely matches the job description of each NEO or executive officer position, and for the companies that are most closely aligned with characteristics of the Company, including comparable industry, comparable size (revenue and employees) and other measures of comparison as appropriate and available.

The Company also uses a Chemical Industry chemical industry peer group of 14 companies (“Peer Group of 12 companiesGroup”) as an additional reference point for data regarding total compensation. The companies included in the Chemical Industry Peer Group were selected because of their chemical industry affiliation and similarity to the Company in size and/or business. The following companies comprisecomprised the Chemical Industry Peer Group used in reviewing and establishing 2010considering 2012 total compensation: Albemarle Corporation; Arch Chemicals,A. Schulman, Inc.; Ashland Inc.; Cabot Corporation; Cambrex Corporation; Chemtura Corporation; Cytec Industries Inc.; Ferro Corporation; Georgia Gulf Corporation; H.B. Fuller Company; The LubrizolInnospec Inc.; Kraton Performance Polymers, Inc.; NewMarket Corporation; OM Group, Inc.; PolyOne Corporation; and NewMarketSensient Technologies Corporation.

18The Company performs periodic evaluations of the Peer Group in order to ensure the Company is comparing itself with companies who have a specialty chemicals focus, who are within a reasonable range of Company market capitalization size, who are members of the American Chemistry Council, companies which identify the Company in their industry peer groups and/or other related factors. An evaluation was made in 2011 and changes were made to the Peer Group at that time. The Committee believes the current Peer Group remains an appropriate comparison group.

Based on a review of this information,the Towers Watson and Peer Group survey data, the Company targets total compensation for executive officers to be in the median range (plus or minus 10% of the 50th percentile) of the survey data. All NEOs’ and executive officers’ total compensation amounts were considered to be within appropriate and reasonable levels as compared to the survey data considering experience level, time in position, global job grades and any other relevant factors.both external and internal equity evaluations.

The Company has a long-term target total compensation mix of 40% base salary, 20% short-term incentives and 40% long-term incentives for executive officers’ compensation. This target objective provides an appropriate mix of short-term and long-term rewards and incentives to encourage the necessary focus and motivation to achieve outstanding results on an ongoing basis, both in the short-term and long-term. In addition, the combined focus on both short-term and long-term objectives aligns Company and stockholders’ interests. The allocation of compensation, emphasizing both short-term and long-term goals, is common market practice and appropriate in order to reduce the possibility of any material adverse effect on the Company due to the Company’s

19

compensation policies and practices. Short-term incentives for executive officers are based on individual and Company performance. Long-term incentives for executive officers are based only on Company performance. This mix assumes above average Company performance and can vary considerably if performance is either below average or at a superior level. For 2010,2012, the actual total compensation mix for all nine executive officersthe NEOs was 49.6%40.4% base salary, 22.3%29.4% short-term incentives and 28.1% long-term incentives. For the NEOs, the mix was 47.6% base salary, 24.3% short-term incentives and 28.1%30.2% long-term incentives.

Elements of Compensation

For the fiscal year ended December 31, 2010,2012, the principal elements of compensation for the executive officers, including the NEOs, were as follows:

| Compensation Element / Purpose | Description | |

Base Salary To attract and retain | Fixed component of pay based on specific position salary ranges determined by job responsibilities, competitive benchmark data and performance | |

Short-Term Incentives To drive year-over-year financial | Variable, annual, at risk component of pay that rewards achievement of pre-determined Company and individual goals | |

Long-Term Incentives To promote retention of executives, | Variable, at risk, equity component of pay for eligible participants that rewards stockholder value creation over | |

Retirement Benefits To promote retention and to attract outstanding employees | Fixed percentage (4%) of base salary under a Savings and Investment Retirement | |

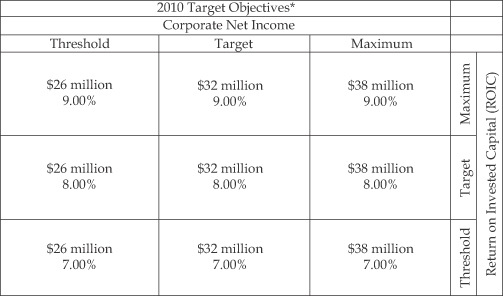

Profit Sharing Plans and Employee Stock Ownership Plans To provide employees with a tax deferred retirement savings vehicle directly connected to the Company’s financial results | Variable, annual, at-risk component directly determined by Corporate Net Income achieved | |